Volume 82: Digital Asset Fund Flows Weekly Report

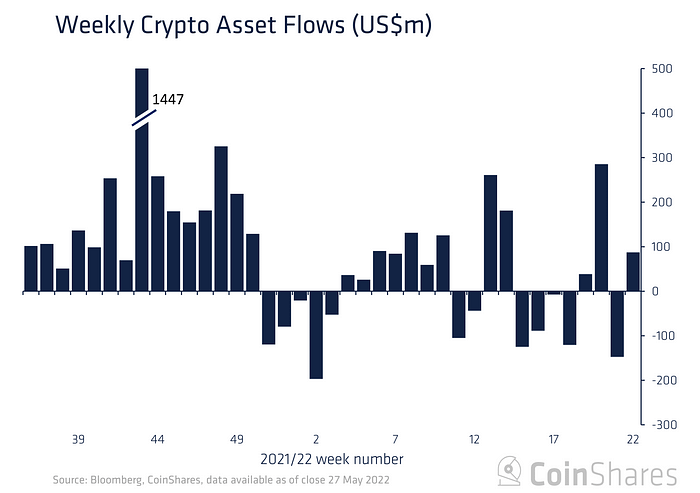

Buying on weakness with inflows of US$87m but market hasn’t shrugged off the bearishness

- Digital asset investment products saw inflows totalling US$87m last week, pushing year-to-date inflows just past the half a billion mark to US$0.52bn.

- Bitcoin saw inflows totalling US$69m, bringing year-to-date inflows to US$369m although, due to price weakness, total assets under management (AuM) are now at their lowest point since July 2021.

- Short Bitcoin saw inflows totalling US$1.8m last week suggesting the market hasn’t completely shrugged-off its bearish undertones.

- Algorand, the defi focussed protocol, saw record inflows last week totalling US$20m.

Digital asset investment products saw inflows totalling US$87m last week, pushing year-to-date inflows just past the half a billion mark to US$0.52bn. It remains well below year-to-date inflows this time last year which were at US$5.9bn. It is encouraging given the negative price action of 34% for Bitcoin this year, and implies investors are buying on price weakness.

Regionally, North America saw inflows totalling US$72m while Europe saw US$15.5m, the first time for over a month where we have seen coordinated inflows.

Bitcoin saw inflows totalling US$69m, bringing year-to-date inflows to US$369m although, due to price weakness, total assets under management (AuM) are now at their lowest point since July 2021. Short Bitcoin saw inflows totalling US$1.8m last week suggesting the market hasn’t completely shrugged-off its bearish undertones.

Ethereum resumed it grind lower with outflows totalling US$11.6m last week, bringing net outflows year-to-date to US$250m, a stark contrast to most other altcoins.

Algorand, the defi focussed protocol, saw record inflows last week totalling US$20m, likely triggered by new product launches.

Most other altcoins saw inflows, most notable were Multi-asset, Solana and Tron at US$4.8m, US$1.8m and US$0.4m respectively.

To see the full report, click here.